The Reuters news staff had no role in the production of this content. It was created by Reuters Plus, the brand marketing studio of Reuters.

PRODUCED BY REUTERS PLUS FOR

On a mission: Attracting capital to US housing

Single-Family Social Bonds from Fannie Mae aim to help direct capital to support housing challenges that consumers face throughout the United States. Investors can gain insights from the Mission Index™ to understand the mission-oriented lending activities underlying Single-Family mortgage-backed securities (MBS).

Fannie Mae was first chartered

over

85

years ago

and supporting quality affordable rental housing.

promoting access to credit for low- to moderate-income borrowers

Explore landscape

This role includes

In doing so, it provided

$369bn

to provide liquidity, stability and affordability to the US housing finance system.

Last year, Fannie Mae owned or guaranteed approximately

1/4

of single-family mortgage debt outstanding in the US.

in liquidity to the housing market and helped 1.5 million households buy, refinance or rent a home.

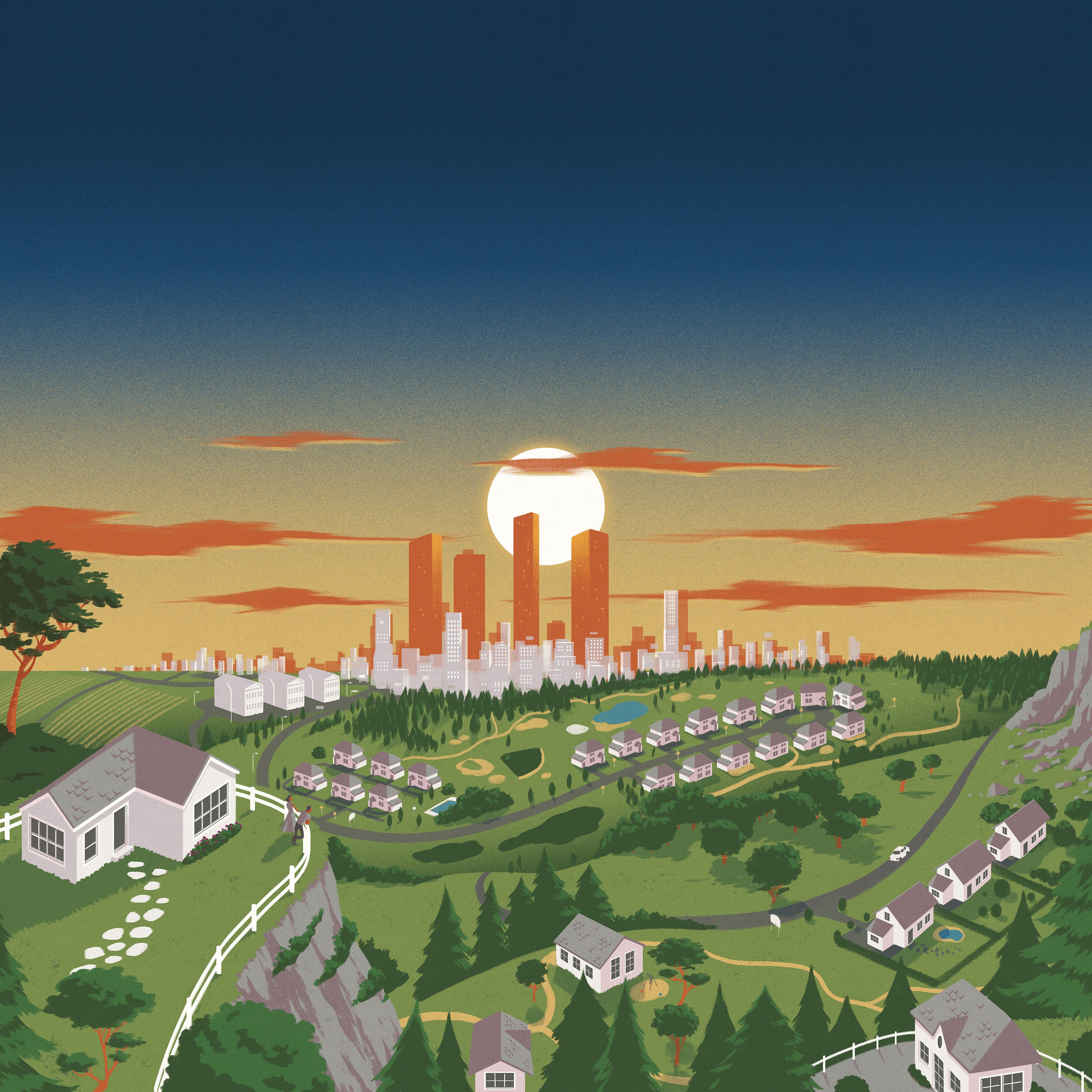

Fannie Mae knows that the journey to stable housing is varied and at times challenging for many people across America, especially in the context of today’s macroeconomic landscape.

Ensuring liquidity, stability and access in a challenging landscape

While mortgage rates and home prices are expected to ease in the coming years, affordability remains constrained by high interest rates, limited housing stock and elevated home prices.

Fannie Mae is working hard to increase access to mortgage credit for qualified homebuyers.

380,000

In 2023, Fannie Mae helped over

consumers purchase their first home

45%

...representing

of its single-family mortgage acquisitions

189,000

...and helped over

low- and very-low-income buyers purchase a home.

Mission Index: Unique insights into socially aligned MBS

In response to increased investor interest in allocating capital to support affordable housing, Fannie Mae developed the Mission Index. Fannie Mae is uniquely positioned to provide information about the underlying characteristics of mortgages it acquires. The insights provided by this innovative disclosure solution allow investors to identify mortgage-backed securities (MBS) with high concentrations of loans that align with the mission objectives of Fannie Mae.

The Mission Index scores each MBS across three dimensions:

Income

Borrower

Property

Income criteria identify loans made to low-income borrowers or to finance affordable rentals.

Borrower criteria include whether a borrower is a first-time homebuyer, in an underserved market, or part of a Special Purpose Credit Program.

Property criteria determine whether the property is in a high-needs rural area, a minority tract, a low-income census tract or a designated disaster area, or whether the property is manufactured housing.

The Mission Index methodology measures how many loans in a pool meet at least one index criteria (the Mission Criteria Share) and how many index dimensions are met, on average, for all loans in the pool (the Mission Density Score).

�Importantly, aggregating sensitive loan data into rolled-up metrics helps to preserve the privacy of individual borrowers. A well-understood historical correlation between the criteria attributes and loan prepayments also gives investors additional insights into likely relative security performance. Investing in high-scoring Mission Index pools will allow investors to support GSE mission lending activities while potentially benefiting from more stable prepayments.

Fannie Mae’s Mission Index and Single-Family Social Bond Framework have significantly increased market transparency by providing pool-level insights into the underlying loans in collateral pools.

Large Asset Manager

Introducing Single-Family Social Bonds

Insights from the Mission Index serve as the foundation for Fannie Mae’s Single-Family Social Bonds, which allow investors to add MBS that align with mission criteria to their portfolio.

The Social Bond framework is credible and impactful.

Fannie Mae’s Social Bonds are designed to attract more global capital to support affordable housing in the US. Growing investor demand for these mission-aligned MBS may also motivate lenders to deploy more capital to previously underserved markets.

Aligned

Validated

Transparent

Disclaimer: The Reuters news staff had no role in the production of this content. It was created by Reuters Plus, the brand marketing studio of Reuters. To work with Reuters Plus, contact us here.

For more information on how the Mission Index can be effectively leveraged in your portfolio, or how you can invest in Fannie Mae’s Single-Family Social Bonds, click here.

1

2

3

4

close

close

close

close

The framework is aligned to the International Capital Markets Association’s Social Bond Principles and the United Nations Sustainable Development Goals.

It is validated by a second-party opinion from Sustainalytics, a leading independent global provider of ESG and corporate governance research and ratings.

Transparent annual impact reporting on the social impact of the loans underlying the bonds further bolsters investors’ ability to establish how the bonds align with portfolio objectives.

On a mission: Attracting capital to US housing

This communication does not constitute an offer to sell securities (nor it is an offer to the general public in the European Union) and is informational only. Before considering an investment in any Fannie Mae security, prospective investors should obtain, read and understand the offering documents and disclosure information for those securities.

The Reuters news staff had no role in the production of this content. �It was created by Reuters Plus, the brand marketing studio of Reuters.

PRODUCED BY REUTERS PLUS FOR

Disclaimer: The Reuters news staff had no role in the production of this content. It was created by Reuters Plus, the brand marketing studio of �Reuters. To work with Reuters Plus, contact us here.