The Loan

We All Own

Building on 30 Years

of Multifamily Success

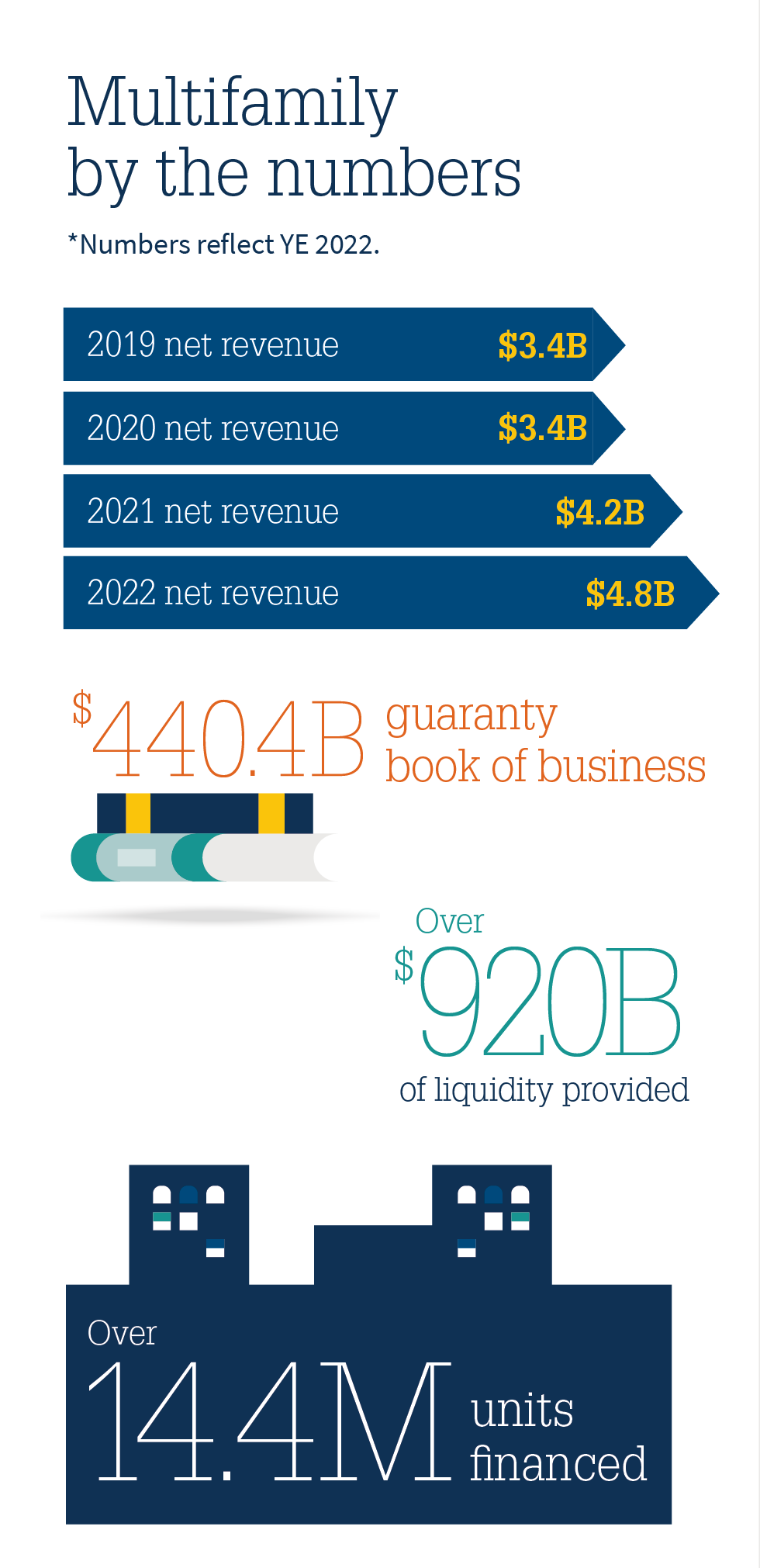

For over 30 years, Fannie Mae has been a leader in the multifamily market. Through challenging and disruptive real estate cycles, we've remained true to our mission to facilitate equitable and sustainable access to homeownership and quality affordable rental housing across the United States. We're continuing to embrace change. Our focus on innovation and our commitment to providing the financing solutions our customers need and grow as we explore new ways to meet the needs of the market, serve the needs of renters, and make it easier to do business with us.

For over 30 years, Fannie Mae has been a leader in the multifamily market. Through challenging and disruptive real estate cycles, we've remained true to our mission to facilitate equitable and sustainable access to homeownership and quality affordable rental housing across the United States. We're continuing to embrace change. Our focus on innovation and our commitment to providing the financing solutions our customers need and grow as we explore new ways to meet the needs of the market, serve the needs of renters, and make it easier to do business with us.

Nothing we do is possible without our lender partners. They bring in quality deals and make smart credit decisions, helping us build a strong book of business. They test new technology and ways of working that help us build faster, smarter systems. They're committed to creating and preserving housing that produces positive outcomes for renters. They're identifying opportunities to create a more diverse and inclusive industry. And every day, they prove that we can achieve more together.

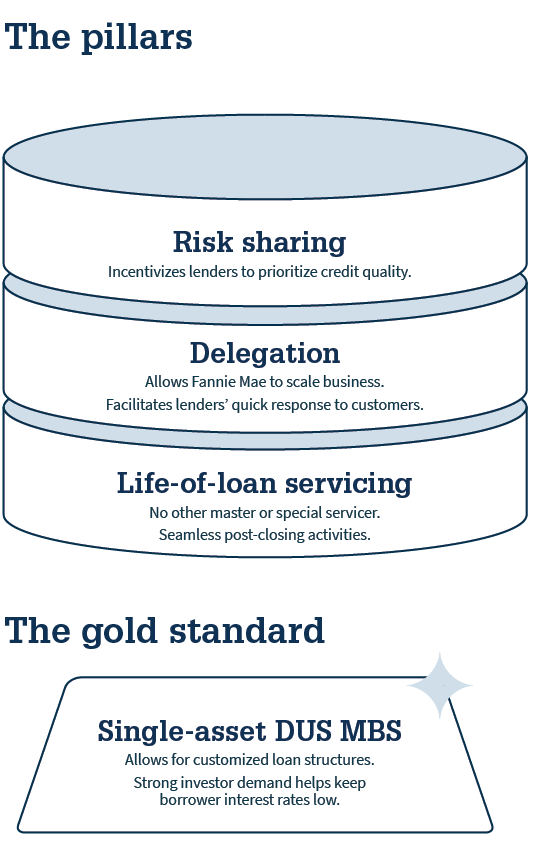

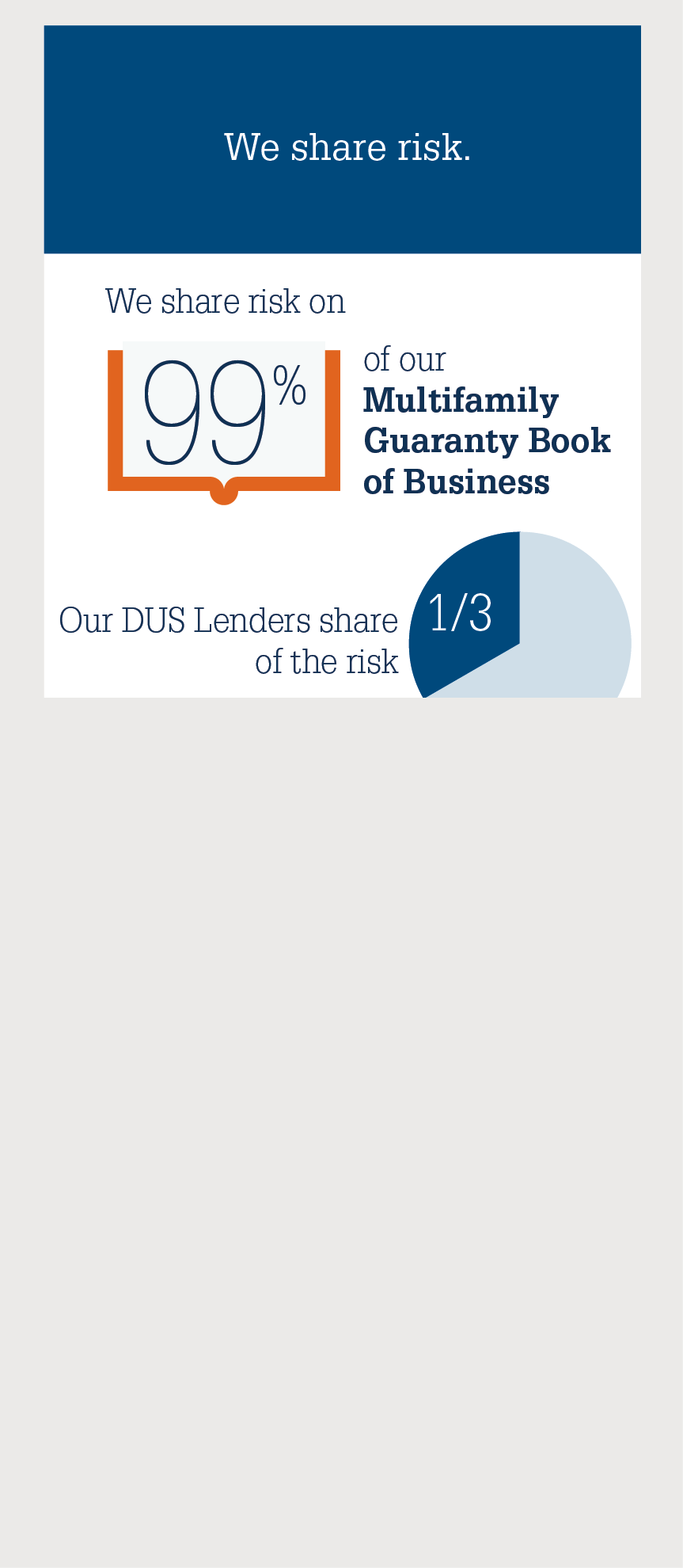

With the Delegated Underwriting and Servicing (DUS®) model as the foundation of our business, we'll continue to withstand difficult changes and lead positive ones. Delegation, risk-sharing, and life-of-loan servicing are the pillars that support our platform and allow us to serve every market, every day. We're dedicated to the future of housing and are grateful for the people, products, and processes that will help us shape it.

We've created this overview of our business and how we execute it to help explain the DUS model and highlight our work across the spectrum of multifamily housing. Together, these pages tell the story of how we're serving renters and executing on our mission. I think you'll agree that it's a story worth telling.

Michele Evans

Executive Vice President,

Head of Multifamily, Fannie Mae

Congress created Fannie Mae in 1938 to provide a reliable, steady source of funding for housing. Our role is to provide liquidity and stability to the mortgage market. We do not lend directly to consumers. Instead, we operate in the secondary mortgage market, in two business lines:

- Single-Family (1 - 4 residential units)

- Multifamily (5+ residential units)

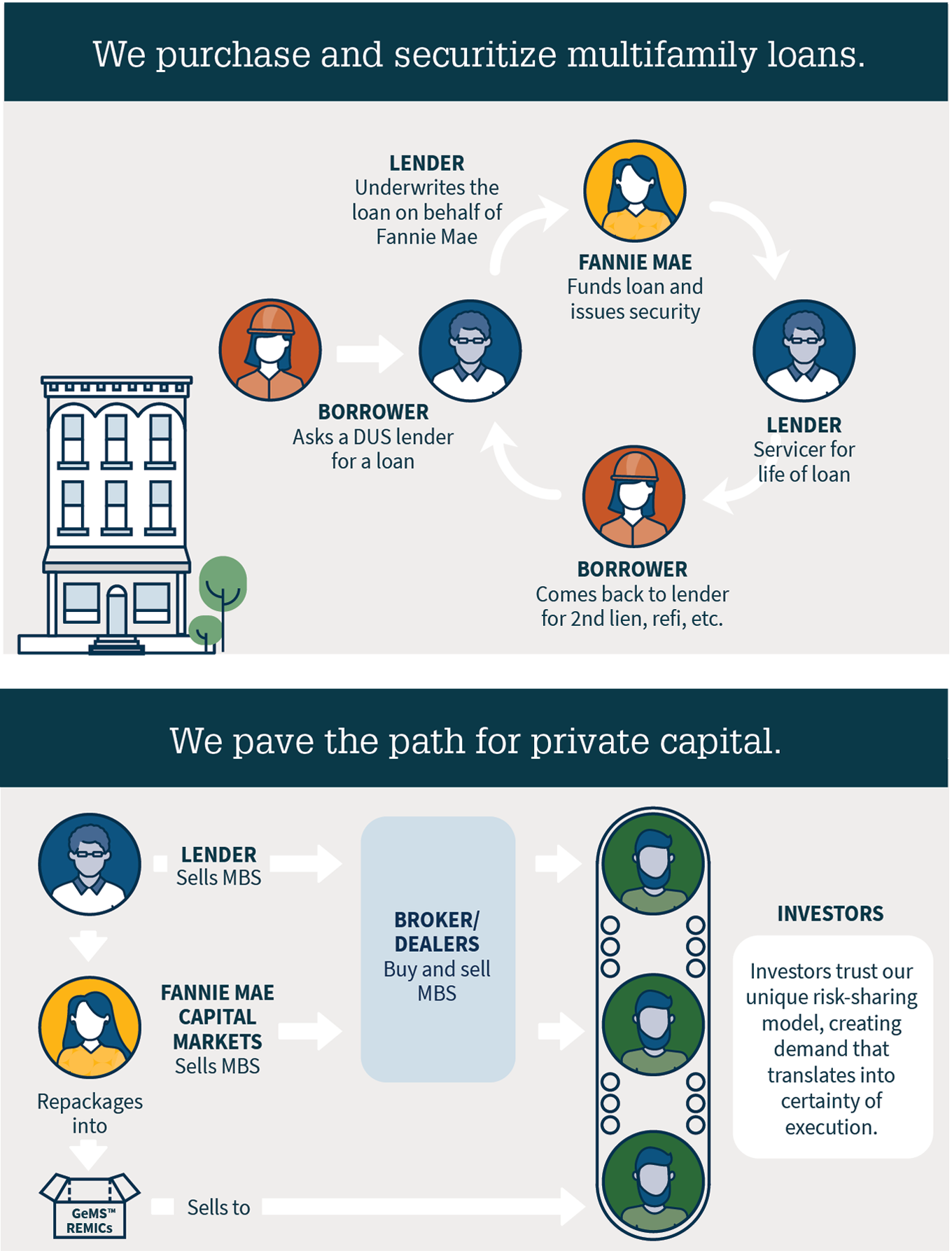

We facilitate the flow of global capital into the U.S. mortgage market by assuming and managing credit risk. We securitize Multifamily mortgage loans delivered to us by lenders into Fannie Mae MBS in lender swap transactions. Nearly all of our multifamily acquisitions are through MBS issuances.

Conservatorship

Fannie Mae has operated under the conservatorship of our safety and soundness regulator, the Federal Housing Finance Agency (FHFA), since September 6, 2008. In September 2008, Treasury made a commitment under a senior preferred stock purchase agreement to provide funding to Fannie Mae under certain circumstances.

Please refer to our SEC filings for information about Fannie Mae and the operation of the company during conservatorship.

As one of the largest guarantors of mortgages in the United States, we play a major role in setting the standards for the housing finance market. We drive market standards through our underwriting guides, disclosure and asset management tools, data standards, and constant engagement with our lender partners.

A DUS Story

For over 30 years, Fannie Mae Multifamily has been a reliable source of mortgage capital for the secondary market. We provide liquidity, stability, and affordability in every market, every day, and we do so while maintaining our rigorous credit standards and expanding access to affordable housing. Our Delegated Underwriting and Servicing (DUS®) model is the premier financing platform in the multifamily market.

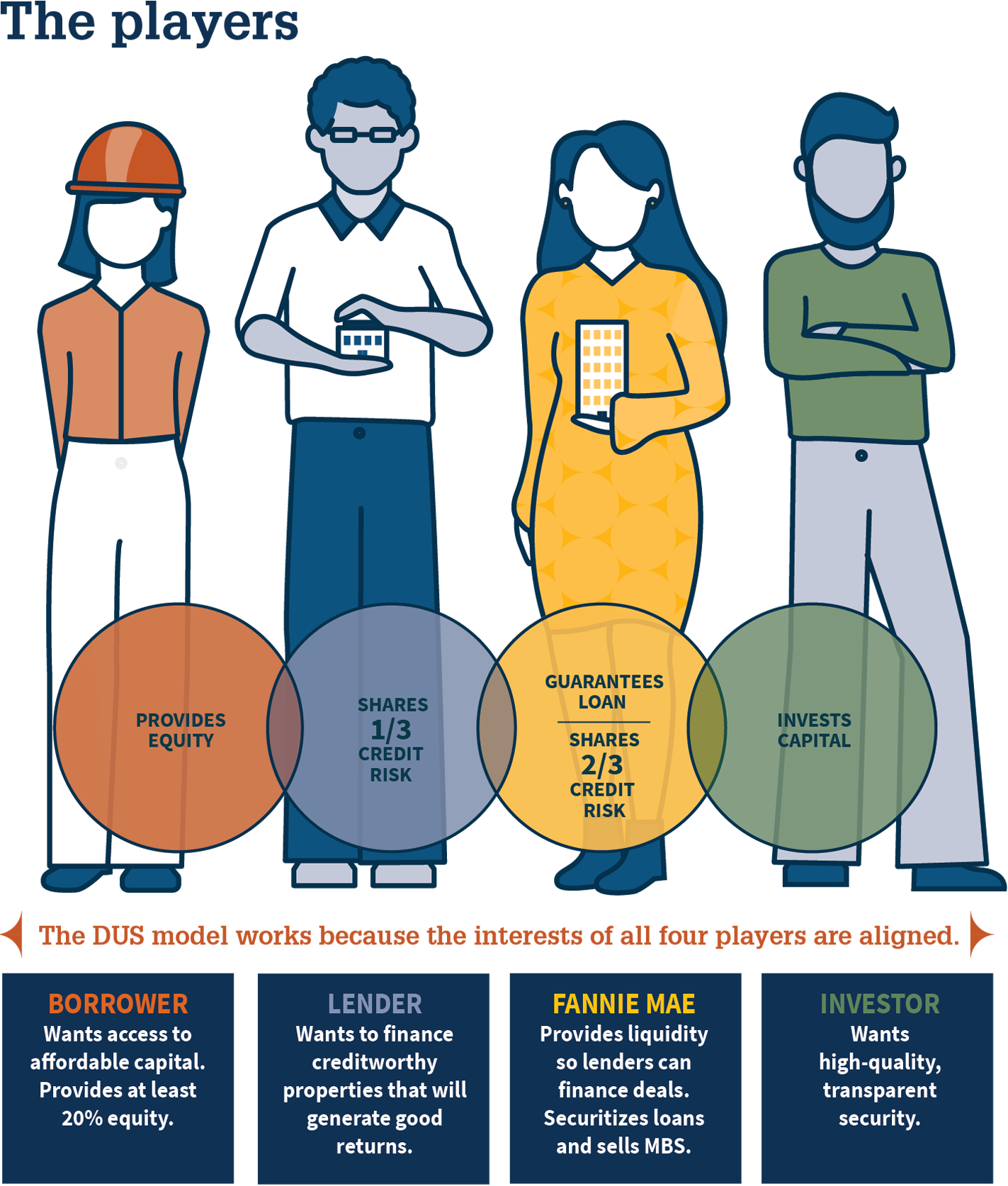

DUS is a unique system of collaboration. In certain cases, we authorize our 24 DUS lenders to underwrite, close, and deliver loans on our behalf. In exchange, they share the risk of loss on those loans. In turn, this offers borrowers certainty of execution, faster decisions, quicker closings, and competitive pricing. It is a complete partnership – we share the risk, and we share the reward. It’s also why we describe it as The Loan We All Own® — because it aligns and empowers each of us, every step of the way.

Fast. Flexible. Certain.

We serve a wide spectrum of the market, including conventional, rent-restricted, cooperatives, seniors housing, student housing, and manufactured housing communities.

We finance all loan sizes, from a $1 million single-asset MBS to a $1 billion+ structured transaction.

DUS leverages private capital, aligns interests through risk sharing, and supports life-of-loan-servicing.

Countercyclical stability

We consistently provide access to credit throughout economic cycles. When other sources of capital retreat, Fannie Mae is still there to provide funding and liquidity.

Standard-bearer

Our underwriting and servicing guidelines and loan documents set the industry standards for multifamily underwriting and servicing best practices, promoting standardization and transparency and facilitating reliable securities disclosures.

Delegation and scalability

Our unique delegated model means we can scale our business as market conditions change, because we delegate underwriting and servicing to our DUS lenders.

Life of loan servicing

Life-of-loan servicing means no other master or special servicer and seamless post-closing activities. This life of loan relationship also makes second liens, supplementals, and refis quick and efficient.

The DUS Network

We maintain strong relationships with our 24 DUS Lenders, who all exhibit:

- Financial strength.

- Extensive multifamily underwriting and servicing experience.

- Strong portfolio performance.

- Creation of quality branded product.

Risk-sharing

Thanks to our unique risk-sharing model, the interests of borrowers, lenders, and Fannie Mae are aligned throughout the life of the loan. We believe this alignment of interests improves the performance of all parties and optimizes outcomes.

Single-security MBS

Our DUS MBS, backed by a single asset, transforms a mortgage loan into a more liquid asset, which increases available funds in the financial system. Our securities offer strong credit ratings as Fannie Mae guarantees timely payment of both principal and interest.

We are present for the life of the loan.

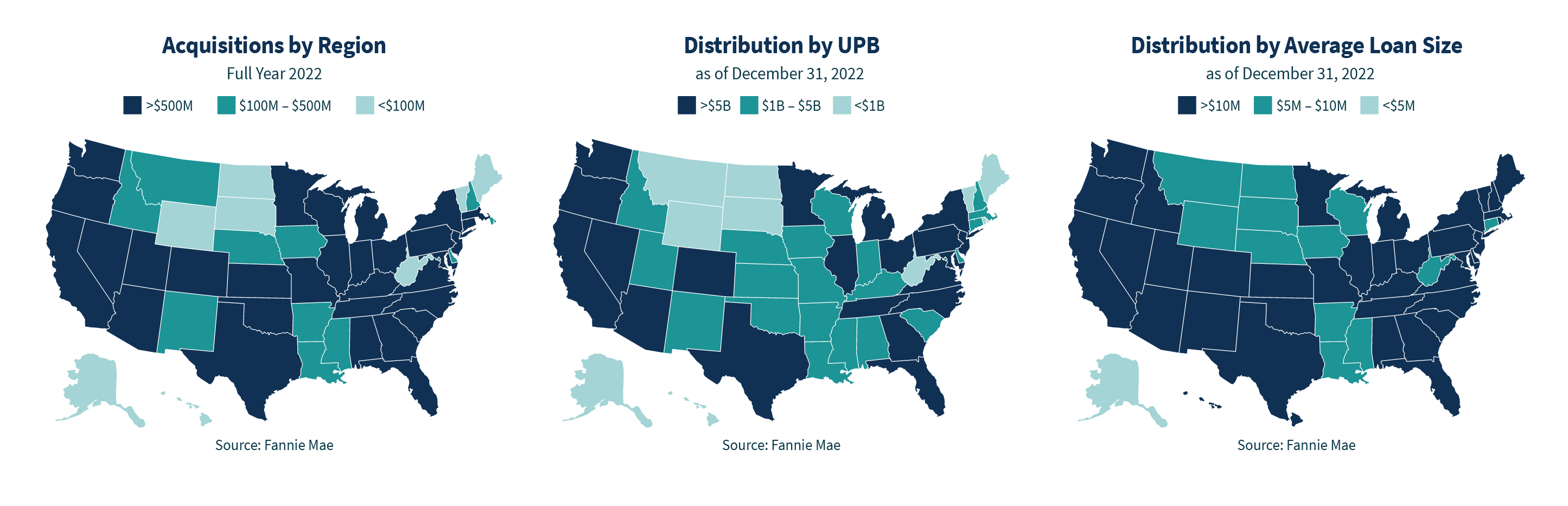

We are in every market, every day

We serve the secondary mortgage market as a reliable source of multifamily mortgage capital in every market, every day. We provide liquidity, stability, and affordability to the multifamily market in a disciplined fashion while maintaining our credit standards and mitigating losses.

We offer stability by financing multifamily loans of all sizes.

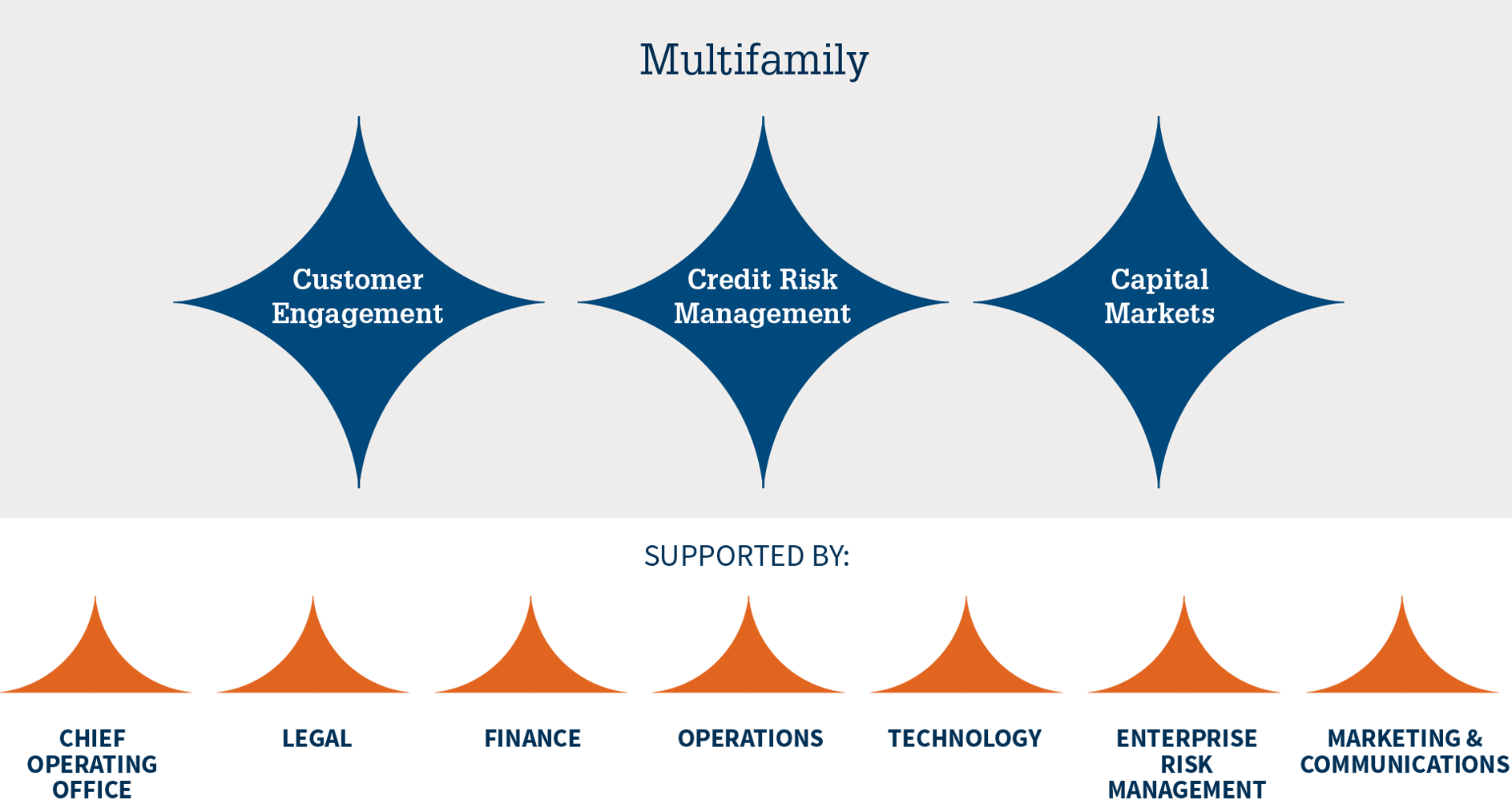

We are optimized to lead the market

With over 500 multifamily housing finance professionals across the country, the multifamily team is organized to best achieve our mission. Our leadership team sets the tone, and our Deal Teams and specialty financing teams provide the transactional expertise and relationship management that elevate the Fannie Mae Multifamily experience above the competition. Our regional Credit and Customer Engagement teams provide both local market expertise and engagement that help lenders achieve their business and portfolio objectives. Our Capital Markets group buys and sells DUS MBS, helping ensure that there is demand for our securities and attracts new investors. In-house legal, finance, marketing and communications, and economics teams are all focused on the Multifamily business and how they can best support the business in meeting their objectives to get the right deals done quickly and seamlessly and fulfill our mission.

For more information about the Multifamily team, visit https://www.fanniemae.com/multifamily/leadership

We pave the path for private capital

By offering high-quality, transparent securities, we attract private capital to the secondary mortgage market, helping ensure continued liquidity.

Fannie Mae DUS MBS and GeMS™ structured products trade in the secondary market. DUS MBS and GeMS offer different options for investing in the same multifamily collateral, providing similar cash flows, variations on structure, and slightly different risk profiles.

DUS MBS

Most DUS MBS are backed by a single loan on a multifamily asset. This single loan model means we can offer any loan size, fixed- or variable- rate, terms from 5 - 30 years, flexible yield maintenance, and customized prepayment periods.

Fannie Mae GeMS™

GeMS are comprised of numerous DUS MBS. GeMS maintains the characteristics of DUS MBS with additional benefits, like collateral selected with consistent credit quality and tight maturity profile and structures offering block size, collateral diversity, and pricing close to par.

Green GeMS REMIC

We were the first to issue a Green REMIC tranche backed 100% by Green MBS. Fannie Mae began resecuritizing a portion of our Green MBS through the GeMS program in 2017. Of our over $100 billion in green MBS issuances through the end of 2021, Fannie Mae has resecuritized approximately $14 billion* as Green REMICs through the GeMS program.

*Source: Multifamily Green MBS

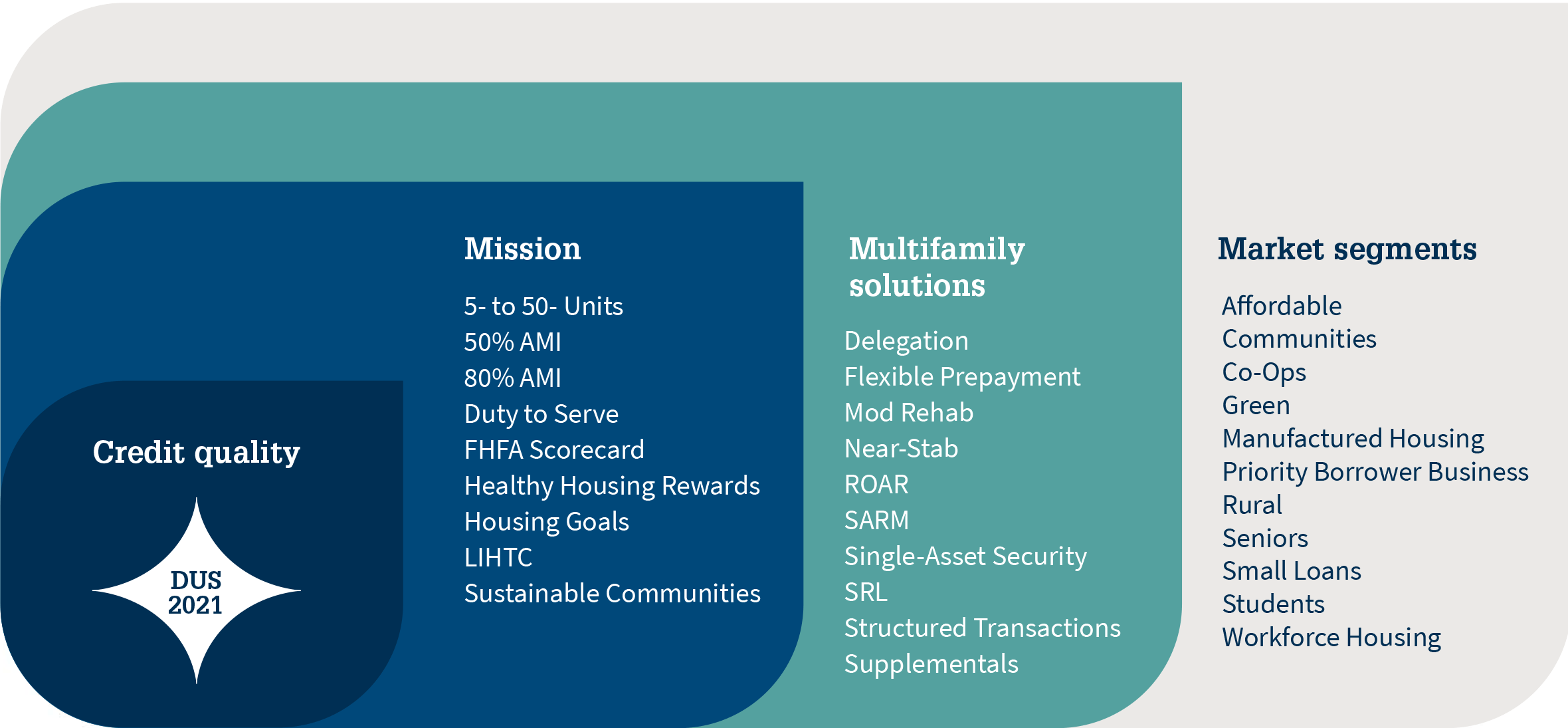

We provide a spectrum of multifamily financing options

No two DUS deals are alike. Borrowers get customized financing through tailor-made terms of varying lengths, prepayments, and add-ons. We offer a variety of options to our lenders, including the option to combine our products for maximum flexibility.

For more information about our financing options, including term sheets, visit https://www.fanniemae.com/multifamily/products

Financing Options

- Conventional

- Cooperative

- Choice Refinance

- Declining Prepayment Premium

- Fixed-Rate Mortgage Loans

- Near-Stabilization Execution

- Negotiated Pools

- Streamlined Rate Lock

- Adjustable Rate Options

- ARM 5-5

- ARM 7-6

- Hybrid ARM

- Structured Adjustable Rate Mortgage Loans (SARMs)

- Structured Transactions

- Bulk Delivery

- Credit Facility

- Supplemental Loans

- Moderate Rehabilitation (Mod Rehab) Supplemental Mortgage Loan

Specialty Asset Classes

- Seniors Housing

- Student Housing

- Military Housing

Mission Business

- Multifamily Affordable Housing (MAH)

- Manufactured Housing Communities (MHC)

- Green Financing

- Healthy Housing Rewards: Healthy Design and Enhanced Resident Services

- Small Loans

- Sponsor-Initiated Affordability (SIA)

- MBS as Tax-Exempt Bond Collateral (M.TEB)

2022 Multifamily Acquisitions by Asset Class

Total multifamily acquisitions* in billions of dollars

We are an essential part of a healthy multifamily market

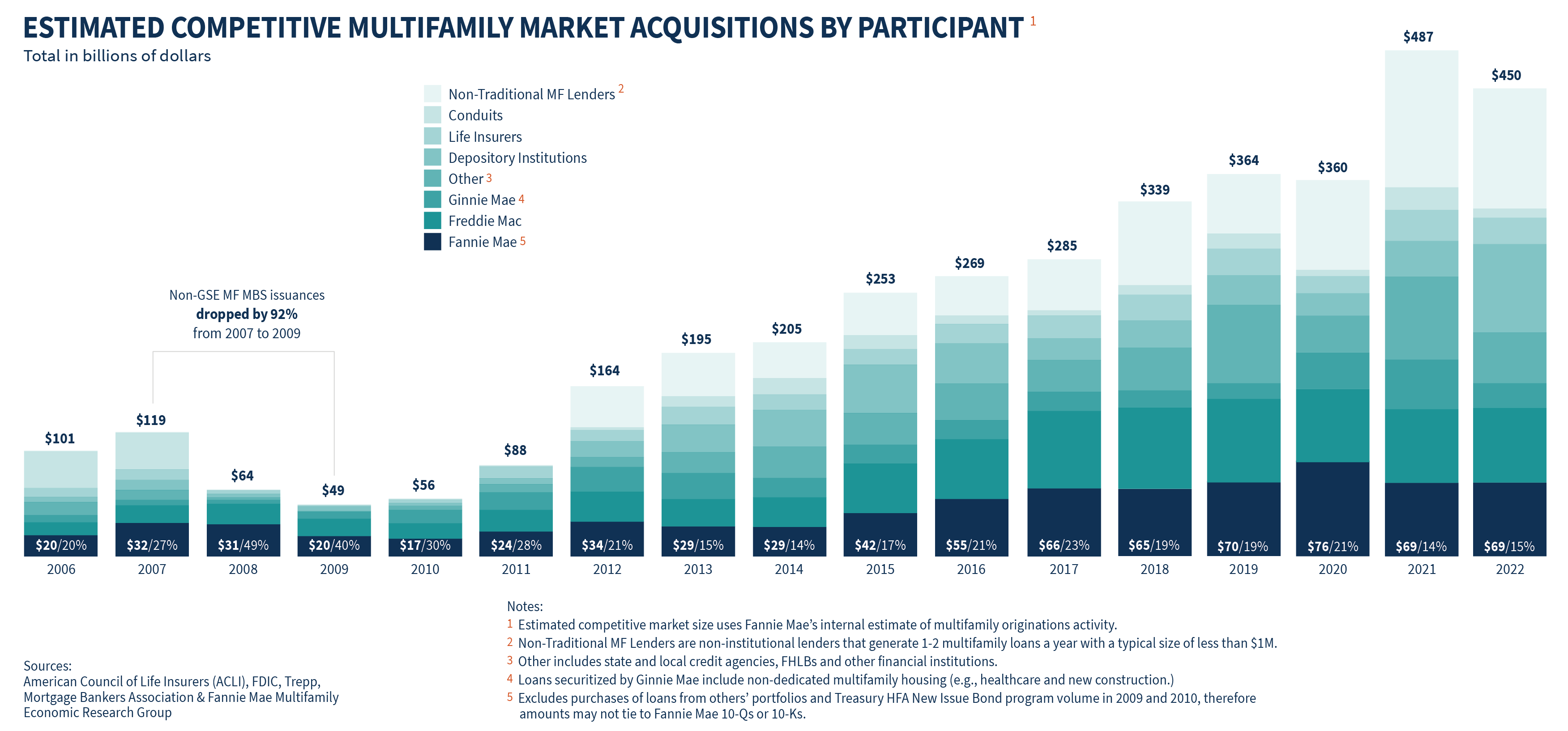

Our footprint expands and contracts as market conditions change. When the market is healthy, we are responsible for about a fifth of acquisitions. When other sources of capital pull back, we can expand our market share to help ensure continued liquidity.

We pursue and win the right business for our portfolio

We are focused on providing liquidity to the multifamily market while creating a balanced guaranty book for Fannie Mae. This means financing strong credit quality business in all market segments and geographies. We balance our affordable business with core business in strong markets and we remain focused on providing the certainty of execution that our customers rely upon.

Our balanced book approach:

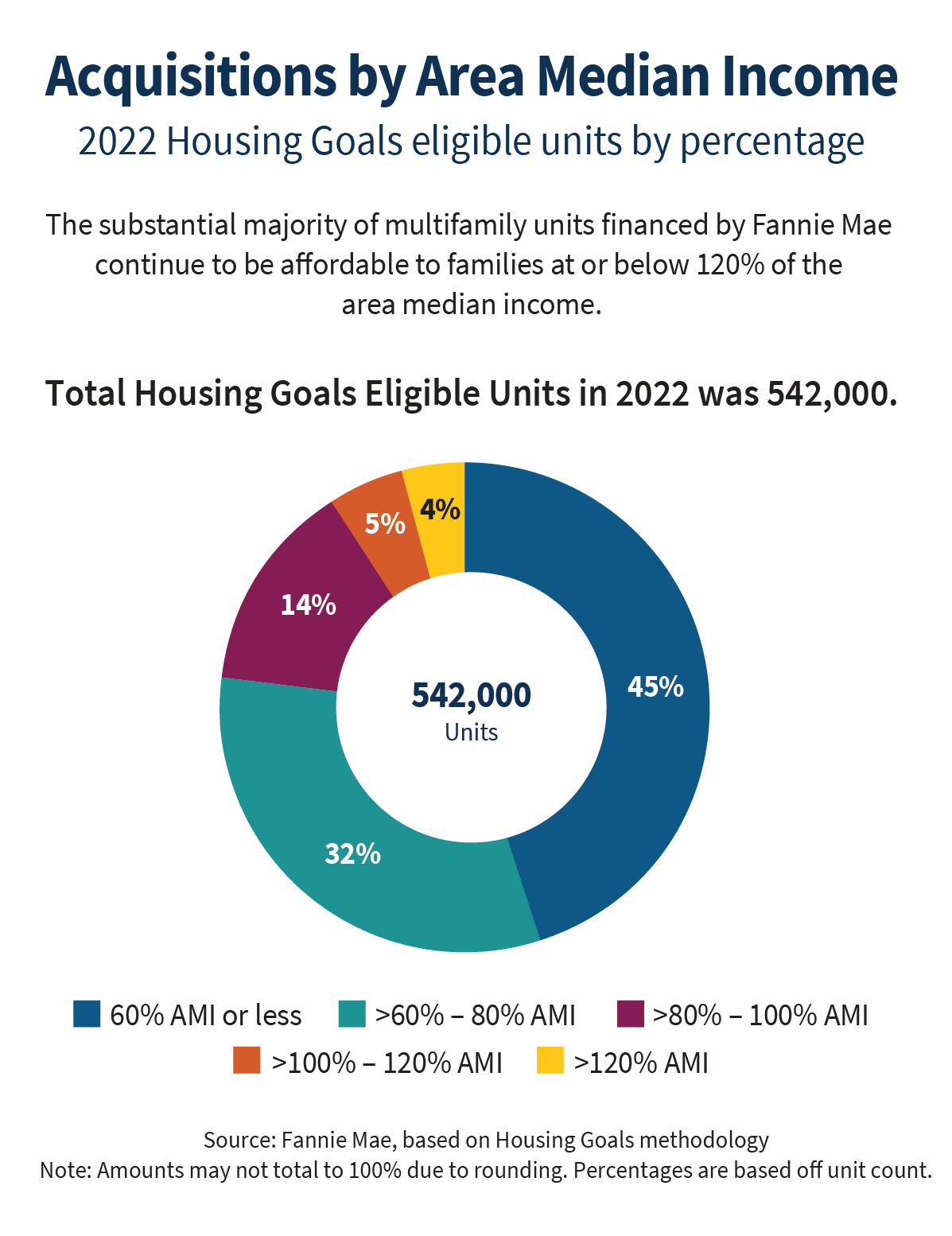

We make affordable rental housing possible

Financing affordable rental housing is at the heart of what we do. We are committed to affordable housing for the long-term and are part of the preservation, rehabilitation, and new construction of quality housing across the United States.

We offer a wide array of affordable financing products including new options like our Sponsor Initiated Affordability (SIA) and Expanded Housing Choice (EHC).

The affordable team can provide the solutions you need for your deals. We are always looking for more ways to help you with your affordable business.

For more information about Multifamily Affordable Housing, visit https://www.fanniemae.com/multifamily/affordable-loans

We offer sophisticated structured solutions

Fannie Mae’s structured finance products are flexible, powerful financing tools that allow borrowers to manage debt across their multifamily portfolios. Credit Facilities and Bulk Deliveries offer a combination of variable- and fixed-rate debt with laddered maturities and flexible post-closing features, so borrowers can sell, acquire, and rehabilitate properties as needed.

Our structured finance team can help lenders finance multifamily properties across all asset classes, including market-rate, affordable, seniors housing, student housing, manufactured housing communities, and military housing.

For more information about our Structured Transactions, visit https://www.fanniemae.com/multifamily/structured-transactions

We are green

Since launching our Green Financing program in 2012, we’ve continued to grow our Green book of business each year, with total issuance of over $100 billion through 2021.

Offering greener, affordable, energy-efficient solutions leads to measurable impact. The energy- and water-efficiency improvements financed through Fannie Mae are projected to generate significant savings while reducing the properties’ environmental impact.

Although the green mortgage market is still a relatively new market, we’ve made tremendous strides over the last few years. In fact, Fannie Mae issued over $13 billion in Green Mortgage-Backed Securities in 2021. With that level of impact, we’re making green financing into more than just a feel-good product: We’re making it the new standard in multifamily lending.

For more information about Multifamily Green Financing, visit https://www.fanniemae.com/multifamily/green-initiative

We are driven by our mission

As a market leader for financing multifamily properties, we work to ensure that access to affordable rental housing is available in all markets across the country. Financing affordable rental housing is at the heart of what we do, and we are committed to the preservation, rehabilitation, and new construction of quality housing. Our innovative products make this goal a reality.

Low-Income Housing Tax Credit (LIHTC) Equity

The federal government's LIHTC program encourages private equity investment in creating and preserving affordable rental housing for low- and very low-income households.

Our LIHTC investments support the creation and preservation of affordable rental housing when and where those needs are not being met. We also target specific areas: underserved markets; populations with unmet needs, including Native American and farmworker communities; supportive housing developments; and disaster-impacted areas.

Learn more.

Expanded Housing Choice (EHC) Housing Choice Voucher Pricing Incentive

Through the Housing Choice Voucher (HCV) Program, the U.S. Department of Housing and Urban Development (HUD) helps provide access to housing for very low-income families, seniors, historically underserved populations, and people with disabilities. HCVs are administered by Public Housing Agencies, which pay a set subsidy toward the rent. The renter is responsible for the difference between the HUD-established fair market rent and the subsidy.

Our EHC initiative lowers borrowing costs when properties meet all eligibility guidelines, including a commitment to accept HCVs as a source of income. By accepting more HCVs, property owners can receive numerous benefits that include a steady stream of rent payments and helping more renters find a stable, affordable place to call home.

Learn more.

Sponsor-Initiated Affordability

We believe in the importance of preserving affordability. With our Sponsor-Initiated Affordability product feature, we provide borrowers with lower borrowing costs when they create or preserve a minimum of 20% of units that are rent-restricted and occupied by households at or below 80% of Area Median Income for the life of the loan. Learn more.

Manufactured Housing

We've led the way in products that benefit renters in Manufactured Housing Communities (MHC). Tenant Site Lease Protections ensure that tenant rights are built into community policies and are now required at all MHCs we finance. Non-Traditional Ownership helps nonprofits, government entities, and residents acquire or preserve communities by offering discounted financing. We continue to support underserved markets in rural areas as part of our Duty to Serve MHC plan.

Learn more.

We've been a consistent pioneer and leader in the push for more sustainable, energy- and water-efficient multifamily housing. Since launching our Green Financing program in 2012, we've continued to grow our green book of business each year. With a total issuance of over $100 billion through 2021, we are a global leader in green bond issuance.

Borrowers can follow one of two pathways to access Fannie Mae's green incentives:

Green Rewards is for existing properties where Borrowers commit to making energy and water-efficient improvements projected to generate consumption and cost savings while reducing environmental impact.

Green Building Certification is for new construction or existing properties with a recognized Green Building Certification.

Our Green Bond Impact Report provides a look at our proven success.

Learn more.

Healthy Housing Rewards

Our Healthy Housing Rewards™ initiative provides financial incentives for Borrowers who incorporate health-promoting design features and practices or impactful resident services in their multifamily affordable rental properties.

Borrowers can follow one of two pathways to qualify for Healthy Housing incentives. Healthy Design is for properties that incorporate features encouraging healthy indoor and outdoor environments, such as improved air quality, building features that encourage physical activity, and more, as evidenced by a recognized healthy housing certification.

Enhanced Resident Services™ is for properties where Borrowers provide resident services for their tenants, such as health and wellness services, work and financial capability support, and child education and academic support.

Learn more.

We are focused on innovation

The future of multifamily finance is digital. Throughout the life of the loan, we've introduced enhancements to make it easier to do business with us. The result: better risk management, faster processes, and smarter decisions.

Digital is better. We're integrating with lender systems to achieve more efficiencies, share data that empowers customers, and improve user experiences. Our DUS 360™ application allows for collaborative asset management that's fully digital — a better system that helps produce better risk management. And, our eServicing application supports the reporting process and streamlines the approval methods for our lenders.

Digital is faster. Our efforts to advance our capabilities won't slow down — and neither will our systems. We save our lenders valuable time and money with application programming interface (API) toolkits. These toolkits connect loan origination and underwriting systems to DUS Gateway®, enabling automated pricing and real-time quotes. Our supporting systems, such as DUS Inspect, DUS Insights, and DUS DocWay, provide lenders with a seamless way to connect with our processes.

Digital is smarter. Rich data will enable the business analytics of the future. We'll mine, analyze, and share our data to support smarter decision making, which will ultimately strengthen our portfolio. We lead the way in multifamily finance, and that means leading the way in the digital space. We look to a better, faster, and smarter future. We'll see you there.

We create and preserve affordable housing with LIHTC

Fannie Mae resumed low-income housing tax credit (LIHTC) equity activities in 2018 to provide a reliable source of capital for affordable rental housing and underserved markets. We work closely with syndicators, developers, and housing experts to target our LIHTC investments, where they will have the most impact.

Our investments in LIHTC support the creation and preservation of affordable rental housing when and where those needs are not being met. We also target specific areas, including:

- Underserved markets.

- Populations with unmet needs, including Native American and farmworker communities.

- Supportive housing developments.

- Disaster-impacted areas.

Since our re-entry into LIHTC equity investment, we have:

- Provided approximately $2.0 billion in equity investments.

- Partnered with 13 syndicators, including six nonprofit syndicator members of the National Association of State and Local Equity Funds (NASLEF).

- Embodied our mission to provide liquidity and stability through market fluctuations.

Since 2018, LIHTC activities have supported the creation and preservation of:

- Nearly 700 affordable properties in 47 states and the District of Columbia.

- Over 50,000 units.

- More than 250 LIHTC investments in rural communities in 39 states.

- Approximately 60 properties for high-needs rural regions and populations, including Native Americans.

Mino-Bimaadiziwin Apartments

Mino-b (short for “mino-bimaadiziwin” and meaning “the good life” in Ojibwe) provides 110 units of affordable housing for members of the Red Lake Band of Chippewa Indians and other community members. Residents have access to an on-site wellness center and educational services as well as the Red Lake Embassy community center. Check out our video here.

We have a Duty to Serve

Our Duty to Serve efforts help us reach and respond to the needs of the country's key underserved markets: manufactured housing, rural housing, and affordable housing preservation. We're supporting sustainable, affordable, and safe rental communities, and we're working with stakeholders to improve the housing finance system.

Duty to Serve helps expand access to affordable manufactured housing options, supports the availability of financing in communities, and explores new approaches to the preservation of affordable housing. Through 2021, we have financed over 694,000 rental units across our targeted markets — a number that will grow as we continue to transform our goals into success stories.

We aspire to be an ESG leader

We're dedicated to creating positive environmental, social, and economic outcomes for individuals, families, and communities through responsible mortgage finance. Our ESG strategy is grounded in our mission. We're committed to driving positive impact, building a stronger, safer, and more resilient housing finance system that creates affordable, sustainable opportunities for renters across the country.

We continue to demonstrate our commitment to environmental sustainability through ongoing improvements to our green mortgage products. Our sustainable bonds include our Green Bond Business, which leverages the power of capital markets to accelerate the transition to a low-carbon economy and greener housing stock. We began issuing social bonds in January 2021, backed by loans on multifamily properties that preserve or create affordable rental housing.

We are a catalyst for diversity and inclusion

Our Future Housing Leaders (FHL) program aims to foster diversity in the housing industry. It is a free, Fannie Mae-led recruiting service that connects college students to paid internships and entry-level job opportunities with companies who are committed to diversity and inclusion and the principles of equal opportunity in employment. Through intentional sourcing and recruiting, FHL exposes college students to careers in housing, providing companies in the housing industry with a more diverse pipeline of college students.

As part of the overarching outreach strategy, FHL partners with the Hispanic Association of Colleges and Universities and Management Leadership for Tomorrow (MLT) for assistance in recruiting at institutions with significant racial and ethnic diversity. In turn, FHL provides students with resources, tools, and training to help them better understand the housing industry and gain on-the-job readiness. By joining FHL, companies can diversify their organizations and help foster a more inclusive industry.

We are here to help

Renters are at the root of what we do. We have always served America's renters, through financing quality rental housing in every market and developing programs and initiatives to expand access. We are committed to providing trustworthy resources to assist renters and homeowners. Fannie Mae's consumer website provides access to reliable information, educational resources, and guidance to help rent or buy a home, refinance, avoid foreclosure, recover from disasters, and more.

On the website, we also developed a tool called the Renters Resource Finder for multifamily renters. The tool is easy to use — multifamily renters simply input their address, which matches them with applicable resources. If they live in a Fannie Mae-financed property, they'll be led to our counseling services for renters. If not, they'll be supplied with other information and resources that could help them get answers to their questions and address their financial situations. Our disaster recovery counseling offers free help to renters in a Fannie Mae-financed property.

Resources

Multifamily Market Intelligence

Find Monthly Market Commentary, Research and Analysis, and our Quarterly Metro Outlook. https://multifamily.fanniemae.com/news-insights

Multifamily Marketing Center

Customize professionally designed materials to support your outreach efforts. https://multifamily.fanniemae.com/financing-options/marketing-center

LinkedIn Showcase

https://www.linkedin.com/showcase/fannie-mae-multifamily/

Social Media

Multifamily Business Information

Find useful information on products and executions, news, and detailed business information. Multifamily Business Information Supplemental Deck

Multifamily Monthly New Business Volumes

https://multifamily.fanniemae.com/investing/multifamily-business-information

Multifamily News Archive

https://multifamily.fanniemae.com/news-insights/multifamily-news

Multifamily Product Information

Multifamily Selling and Servicing Guide

The Guide provides Fannie Mae-approved multifamily sellers and servicers with requirements necessary for their business relationship with Fannie Mae.

https://multifamily.fanniemae.com/applications-technology/dus-navigate

Quarterly/Annual Financial Results and Financial Supplement

https://www.fanniemae.com/portal/about-fm/investor-relations/quarterly-annual-results.html

Monthly Summary Report

https://www.fanniemae.com/portal/about-fm/investor-relations/monthly-summary.html